- 4shares

- Facebook1

- Twitter2

- Pinterest1

- Google+

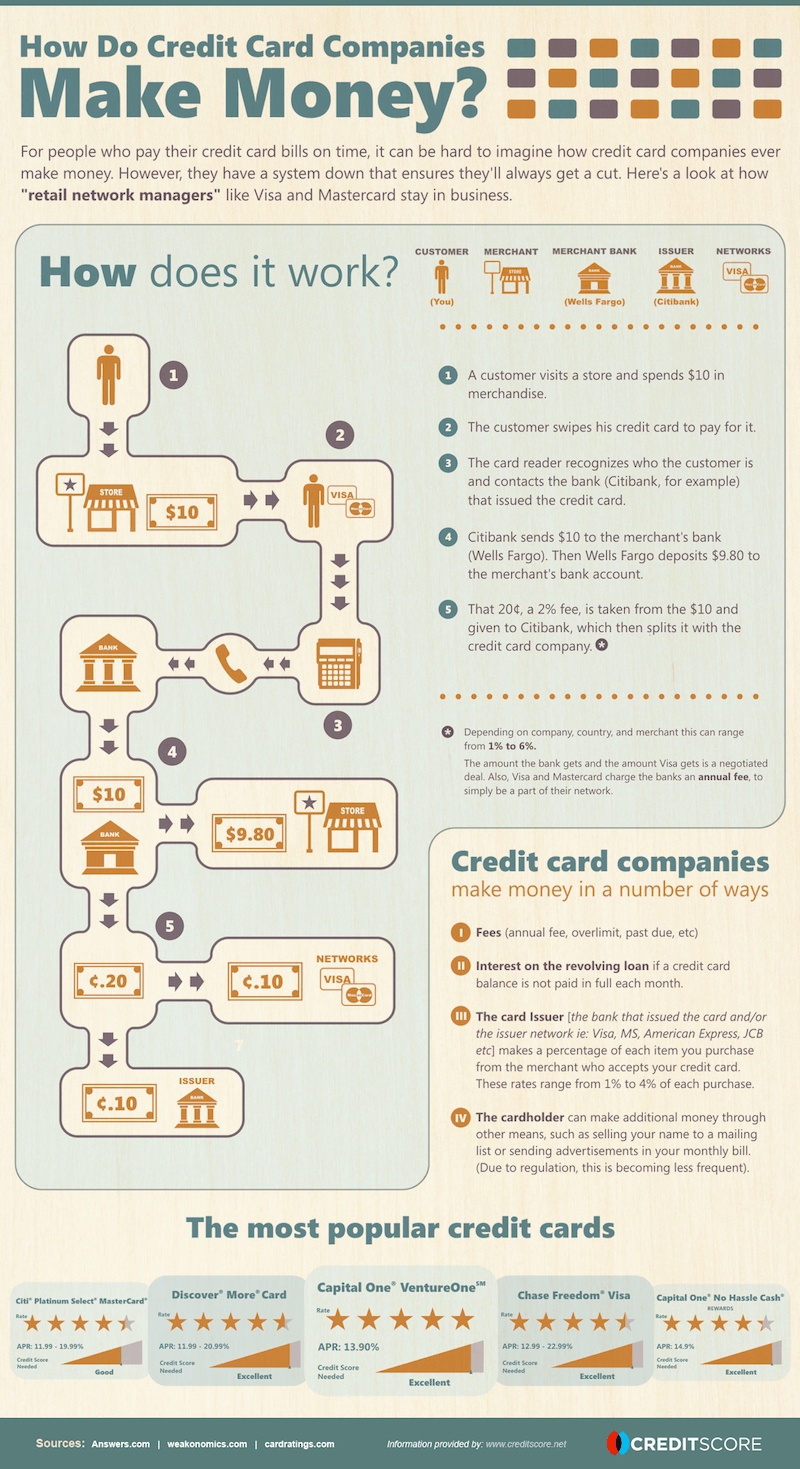

If you have a good credit score, part of that means you’re always paying your credit card bills on time. For people that do pay their bills on time, it can be difficult to imagine how credit card companies ever make money and how much money they could possibly be making. Here’s a look at how credit works and how these companies make their dough.

Click the image for larger version

EMBED THE IMAGE BELOW ON YOUR SITE

EMBED THE IMAGE BELOW ON YOUR SITE