If you have children, you know that they cost money. Many people choose to live in bigger homes or apartments to accommodate children, and, of course, you need to consider the cost of feeding, clothing and tending to the other needs of a child. With inflation, the cost of raising a child goes up. Indeed, the U.S. government estimates that you will spend more than $200,000 to raise a child from birth to age 18.

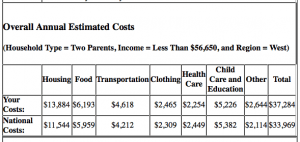

But do you have to spend that much, really? I don’t think I’ll spend that much raising my son. The USDA has a handy calculator that helps you estimate the cost of raising a child. That calculator estimates that, according to my location and my income, my son should cost me $26,000 a year. After a breakdown of costs, I discovered that my son costs me less than that each year. However, I only have one child. What if you had more children? How do you keep costs down?

![]() photo credit: kevindooley

photo credit: kevindooley

How Much Does it Cost to Raise Five Children?

One of my neighbors has five children, ranging in age from 1 to 11. Here are the results of entering information into the USDA calculator:

However, a look at her spending shows that she keeps her expenditures to much less than $37,000 a year for her five kids. For the purposes of this article, we divided total amounts spent by seven (total people in the family) to get a per-person cost, and the multiplied by five to get the cost for the children each year:

- Housing: $10,285.68

- Utilities: $2,571.48

- Health care: $3,857.18

- Groceries/household/hygiene: $5,106.84

- Entertainment/toys/gifts: $428.52

- Clothing: $428.52

- Day camp: $50

- Misc.: $642.84

The total for the year, spent on five children, is $23,371.06. My neighbor admits, though, that she expects her kids to cost more as they get older; she’s already anticipating spending $1,440 a year for the three oldest to take music lessons. This family doesn’t budget in big vacations; they use tax return money for those costs.

If you compare the expenses the government assumes, you can see that one of the big expenses is education/child care. My neighbor is a stay at home mom, and she and her husband trade babysitting with other couples in the neighborhood for date nights. Sometimes, she even watches other children during the day, to earn a little extra money.

Saving Money as You Raise Children

Whether you are raising one child, or raising five, there are things you can do to reduce your expenditures. “We buy a lot of our clothing at the thrift store, or on clearance,” my neighbor says. “But the biggest savings come when we buy off season on top of it.” She doesn’t stop at clothing, though. “Most of our stuff is bought second hand, or handed down.”

She also saves money on food. Interestingly, though, she doesn’t do much couponing. “It never seems to be quite worth the time. But I look for deals. I love case lot sales and buying in bulk. I plan meals, and buy things I know we use in large quantities on sale.” Food storage provides her with savings — and plenty of ingredients for future meals.

For entertainment, they go the frugal route. Plenty of outdoor fun, board games, and movie nights at home. “We sometimes let them sleep downstairs, instead of in their beds,” my neighbor tells me. “We ride bikes to the library, and during the summer we visit every park in town for picnics.”

With a little looking around, creativity, and planning, it is possible to save money as you raise kids. “I’m always looking for deals,” my neighbor says. “I rarely pay full price for anything.”

How much do you spend on your kids?

Miranda is freelance journalist. She specializes in topics related to money, especially personal finance, small business, and investing. You can read more of my writing at Planting Money Seeds.