- 55shares

- Facebook7

- Twitter22

- Pinterest3

- Google+23

When the talk turns to investing, many people shut down. “I can’t invest, I don’t have enough money,” is a common refrain.

The good news is that you don’t need a large chunk of capital to start investing. Thanks to today’s resources, it’s possible to start investing when you have as little as $25. There are even brokerages that will let you invest what amounts to your pocket change.

For some, the idea that it’s possible to invest with a small amount of money isn’t enough to get started. Another regular excuse I hear about investing is this: “Does investing such a small amount really matter? What difference will it make to invest a few dollars a day?”

Once you understand the power of compound interest, and what’s available, you can start to understand that the important thing is getting started — and that consistency over time can lead to a substantial return.

How Much Could You Save Over Time By Investing Now?

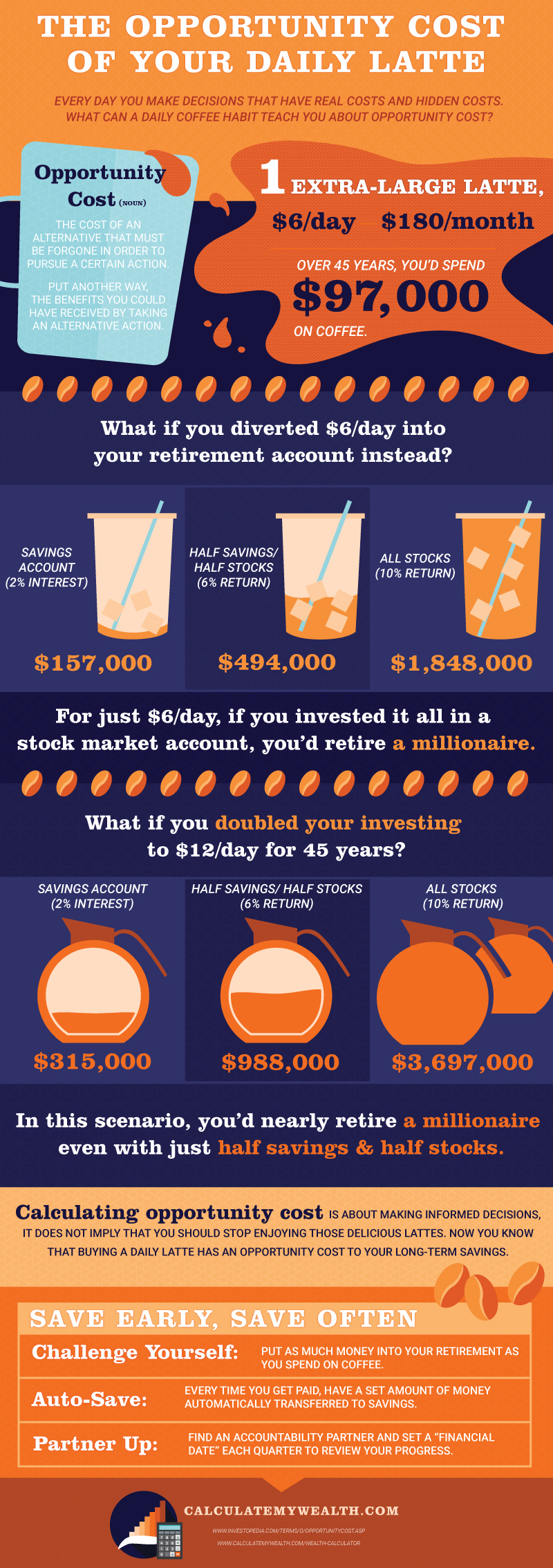

It’s hard to imagine how a small amount can benefit you over time. Calculate My Wealth created this infographic that describes what you can expect when you start investing your money early on, even if you don’t have a lot to invest to start.

Infographic Courtesy of CalculateMyWealth.com

I like this example because it shows how a relatively small amount — $6 per day — can turn into turn into more than $3 million over the course of 45 years. Even if you invest conservatively, you can end up with close to $1 million without every increase that $6 per day investment.

You don’t even have to give up your daily coffee (or other pleasure) in order to make this work. Instead, consider what you might be spending money on that you don’t actually care about very much. Cut that out of your budget and start investing. The idea is to think about where you are spending your money, and how you use it today, and then devote at least the same amount of money toward your future.

Keep Investing and Increase the Amount You Contribute

Once you start investing, the key is to maintain consistency. Make it a point to invest regularly. Most online brokers let you set up an automatic investment plan that allows you to contribute twice a month or once each month. Take advantage of these plans to help you set your investing on automatic, and earmark the money for investing so you don’t wind up spending it on other things. Make investing a priority to start.

After you are comfortable with the amount you are investing, and after your financial situation has improved, start increasing the amount that you set aside. Make it a habit to boost your investing contribution when you get a raise, or when something else happens to improve your finances. If you automatically default to boosting your investment amount in relation to a higher amount of money. If you get a 3% raise, increase your investing by 3%. If you get a windfall, make sure at least part of it is invested.

Consistency over time can change the numbers you see for your nest egg, and it can also change how long you have to keep investing to reach your goals. Calculate My Wealth based their numbers on 45 years of investing. If you increase your contributions over time, there is a good chance that you could hit your goal of $1 million or $2 million without taking nearly so long.

Miranda is freelance journalist. She specializes in topics related to money, especially personal finance, small business, and investing. You can read more of my writing at Planting Money Seeds.