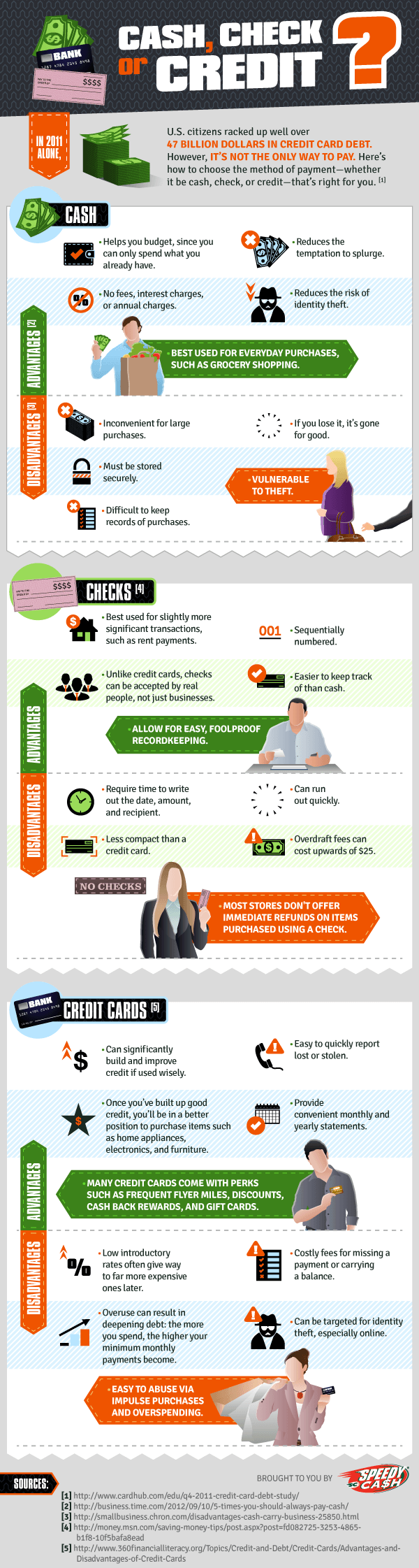

As consumers, we have a number of options when it comes to deciding how we pay for our purchases.

A recent infographic takes a look at some of the common ways to pay, and breaks down the advantages and disadvantages associated with them.

It’s been years since I’ve considered cash a preferred form of payment. You are far more vulnerable to theft, since you can’t get your cash back if it is stolen. Plus, it’s inconvenient and bulky. Other forms of payment just make more sense, and I’m quite partial to credit.

The infographic also takes a look at checks. While I still write checks for the bills that I don’t have on autopay, the number of items I write checks for is dwindling. And, while I need to write a check to the babysitter, the last time my brother sat for me I just sent him money via PayPal.

One of the big downsides to trying to pay with check is the fact that fewer and fewer stores accept check as payment. The number of signs stating, “sorry we don’t take checks” is on the rise in my town — not that I’ve taken a check to the store in several years.

And, of course, you can always pay with credit card. The great thing about paying with credit card (as long as you are responsible and pay off the balance each month) is that you have the potential to earn rewards. You can also receive protections, like fraud liability protection, extended warranty, and car rental insurance.

What Other Payment Options Do You Have?

The infographic does leave out some other ways to pay. I mentioned PayPal above, and that’s becoming a possibility. Some stores are even adding PayPal ability to point-of-sale terminals. So, if you have the right information, you can pay with PayPal at a brick and mortar store without needing a credit card.

The digital wallet is also coming. The grocery store I frequent recently installed new terminals that are compatible for use with Google Wallet. The ability to keep payment information on your smart phone, and pay with that, is creating another change in the way we pay for things.

And, of course, if you like the convenience of plastic, but don’t want to worry about credit, you can use a debit card. There are even debit cards that allow you to earn rewards when you spend. Prepaid debit cards are also finding traction as a payment option. However, if you use a prepaid debit card, you need to watch out for the fees. Some prepaid cards are even becoming more consumer friendly, reducing monthly fees are waiving them altogether.

You have a number of payment options, and you should consider which is most likely to provide you with the convenience you need, without costing you too much to access your own money.

What do you think? What’s your favorite payment method? Why do you like it? Would you consider something like a digital wallet?

Miranda is freelance journalist. She specializes in topics related to money, especially personal finance, small business, and investing. You can read more of my writing at Planting Money Seeds.