- 2shares

- Pinterest2

- Google+

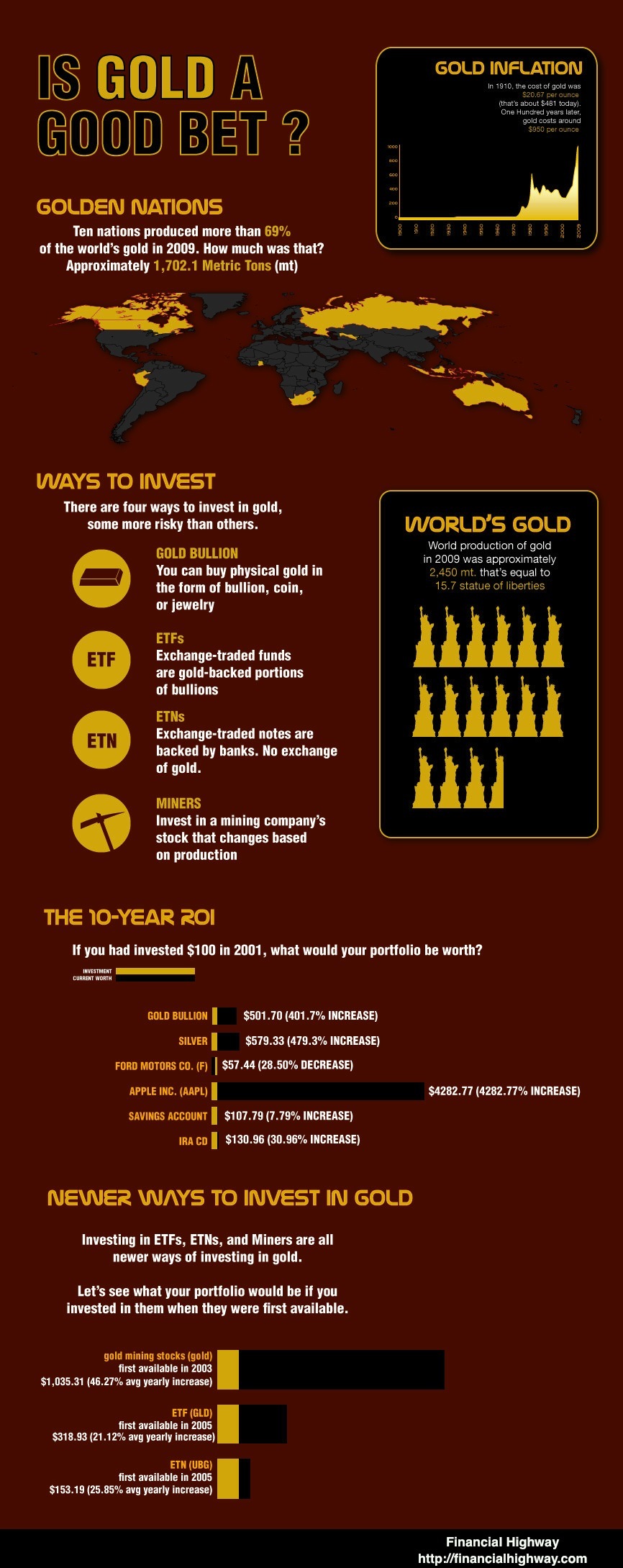

As gold prices continue to set new highs, I receive a lot of emails from readers stating that I was wrong when I said gold is a bad investment. I never said gold prices won’t increase, just that there is not a fundamental method of valuing gold and therefore I do not invest in it. A few years later there still is no method to value gold and although gold prices have increased dramatically, I still do not own any in my portfolio. Obviously, there is nothing wrong with investing in gold, call me old school, but I like investing based on fundamentals and reasonable valuation. Can I predict the markets? No. Do I have a 100% track record? No. But this helps me sleep better at night and we all know that when it comes to investing emotions are an important factor. Having said this, here is a neat visual provided by CaxtonFX.

Click on image to enlarge.

Pin It