Organizing your finances can seem like a daunting task. After all, it can take hours to get everything done, right? The good news is that there is no need to spend a great deal of time on your finances. If you have 10 minutes, you can get in the habit of doing a little something regularly to keep on top of your finances. Here are six 10-minute tasks that can help you organize your finances:

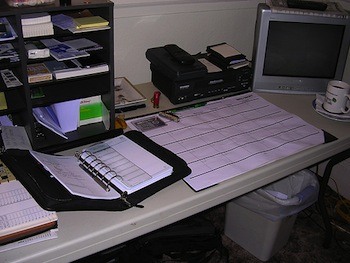

1. Create Folders for Your Financial Documents

You can do this on the computer or in the physical world. The important thing is to create a system to keep everything in its proper place. Start by making the appropriate folders. I have a folder for tax receipts and other documents, a folder for insurance policies, estate planning documents, a folder for medical records, etc. You don’t have to organize everything right now; just set up the system. If you do it on the computer, label your files so that you can scan important documents. (Remember that some financial documents require that you keep the hard copies someplace safe.)

Then, later, when you have another 10 minutes, set a timer for the time and begin filing your papers in the correct place (or scanning documents). It’ll take less than a minute to properly file your documents going forward, and you can organize your past documents in 10 minute sessions.

2. List Your Accounts

You should have a master list of all of your accounts, plus the customer service numbers. This includes investment and retirement accounts, bank accounts, credit accounts and other important financial information. You can create this list fairly easily. Then, put the list in a secure location. A fire safe is a good choice. Incidentally, you can buy a fire safe online in less than 10 minutes.

3. Back Up Your Most Important Documents

My husband’s birth certificate was lost in a flooded basement. (I know, I know. Stupid.) This reinforced the importance of security and back-up copies. Get your most important documents together and scan them onto your computer for a back-up. Then, put the originals in a fire safe to keep them secure.

4. Set Aside Time to Pay Your Bills

Once a week, I pay the bills that have come in since last bill paying time. This usually takes less than 10 minutes, since I have a regular schedule. It is also quick because many of my bills are set up via online bill pay. If you have the opportunity to take advantage of automatic debit, take 10 minutes and see how many accounts you can get set up this way. If you don’t get done, take another 10 minutes the next day.

5. Check In with Your Bank Account

Take 10 minutes to check in with your main checking account. Do a quick scan to make sure that what is showing up in your personal finance software or ledger is in line with what the bank is showing. Look for charges that aren’t yours, and other issues. You can do the same thing online with your credit card accounts. A quick 10 minute scan of your account once a week can be a good way to catch identity theft or mistakes you might have made.

6. Write Down Your Most Important Financial Goals

Re-affirm your financial priorities. Write down your five most important financial goals. Then write a sentence or two next to your goals, explaining what you can do to reach those goals. Writing them down will help you keep them in mind. You can then develop more concrete plans later, in 10-minute chunks if you want.

Miranda is freelance journalist. She specializes in topics related to money, especially personal finance, small business, and investing. You can read more of my writing at Planting Money Seeds.