There are a number of opportunities when it comes to making money through investing. Many people, though, when they think of investing immediately jump to stocks. However, stocks aren’t the only investments worth considering. You can also make money by investing in bonds. When it comes to asset allocation investing in bonds and other fixed income instruments play a critical role.

What are Bonds?

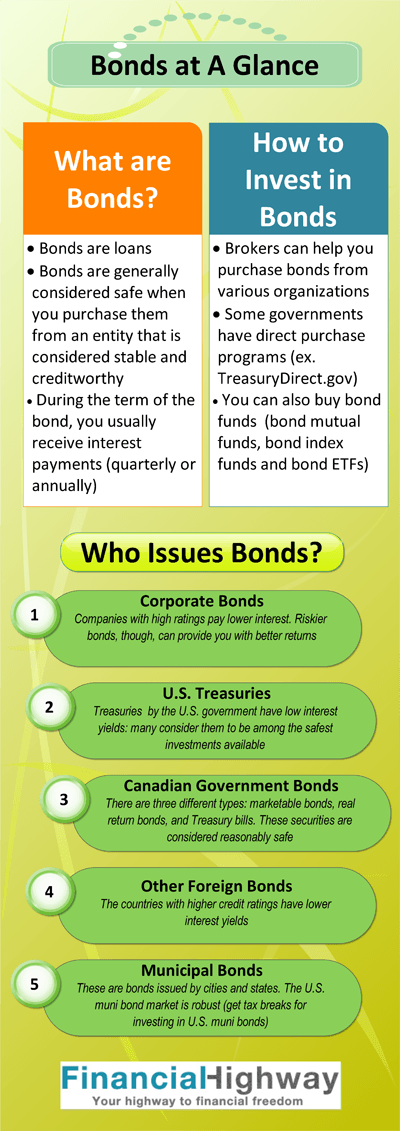

At the most basic level, bonds are loans. Bonds represent debt. An organization — often a business or a government — attempts to raise money by issuing bonds. These bonds are bought by investors looking for a return on their capital. The organization promises to repay the bonds with interest within a certain amount of time.

During the term of the bond, you usually receive interest payments. You might receive interest quarterly or annually. At the end of the term, the amount you paid in principal is returned to you. Bonds are generally considered safe when you purchase them from an entity that is considered stable and creditworthy.

More after the graphic.

Who Issues Bonds?

The bonds you are most likely to see are those issued by governments or companies. Many companies issue bonds to try to raise money for operating costs, and governments routinely sell bonds to cover their costs. Here are some of the more popular bond options:

- Corporate Bonds: Companies issue bond to raise funds. These are bonds from various companies. Companies are given credit ratings meant to indicate how able they are likely to be to repay the obligation later. Companies with high ratings pay lower interest, since they are considered safer. Riskier bonds, though, can provide you with better returns — but you have to be on the alert for a default.

- U.S. Treasuries: These are bonds issued by the U.S. government. Many consider them to be among the safest investments available. Treasuries generally have low interest yields, since they are considered just about as safe as cash.

- Canadian Government Bonds: You can purchase three different types of Canadian government bonds, including marketable bonds, real return bonds, and Treasury bills. Once again, these securities are considered reasonably safe, since the Canadian government is considered stable and creditworthy.

- Other Foreign Bonds: It’s possible to purchase other foreign bonds as well. Many countries issue bonds, and you can diversify your portfolio with bonds from different countries. Once again, the countries with higher credit ratings have lower interest yields. Many investors like to invest in emerging market bonds, since they have higher yields, and the growth means that they are likely to repay the bonds. However, there is still the chance of default.

- Municipal Bonds: These are bonds issued by cities and states. The U.S. muni bond market is robust. And, you can also get tax breaks for investing in U.S. muni bonds.

Pay attention to the credit rating of the bond issuer. While these ratings aren’t full-proof, they can guide you, and provide you a basis for comparison. However, it’s important to remember that the ratings can be deceiving, and that there is always a chance of default — and you could lose some of your principal.

How to Invest in Bonds

More on Fixed Income Investing

The easiest way to invest in bonds is to check with your broker. Many brokers can help you purchase bonds from various organizations. Additionally, it is possible to purchase some bonds directly. Some governments have direct purchase programs. One of the most popular is the program offered by TreasuryDirect.gov. You can set up an account and invest in U.S. Treasuries.

You can also buy bond funds — no need to purchase them one at a time. There are bond mutual funds, bond index funds and fixed income ETFs that can provide you with the ability to diversify your bond holdings, all while keeping your costs down. Depending on the bond fund, it is possible to start with a relatively small amount of money — especially if you set up an automatic withdrawal option.

It’s possible to include bonds as part of an income portfolio, since you can use the interest. Additionally, you can reinvest the interest in other bonds if you are trying to build your portfolio. It’s important to pay attention to the term, though, since you don’t want to end up with all of your bonds coming due at once. You will need to keep them rolling if you plan to use bonds as an income investment.

Miranda is freelance journalist. She specializes in topics related to money, especially personal finance, small business, and investing. You can read more of my writing at Planting Money Seeds.