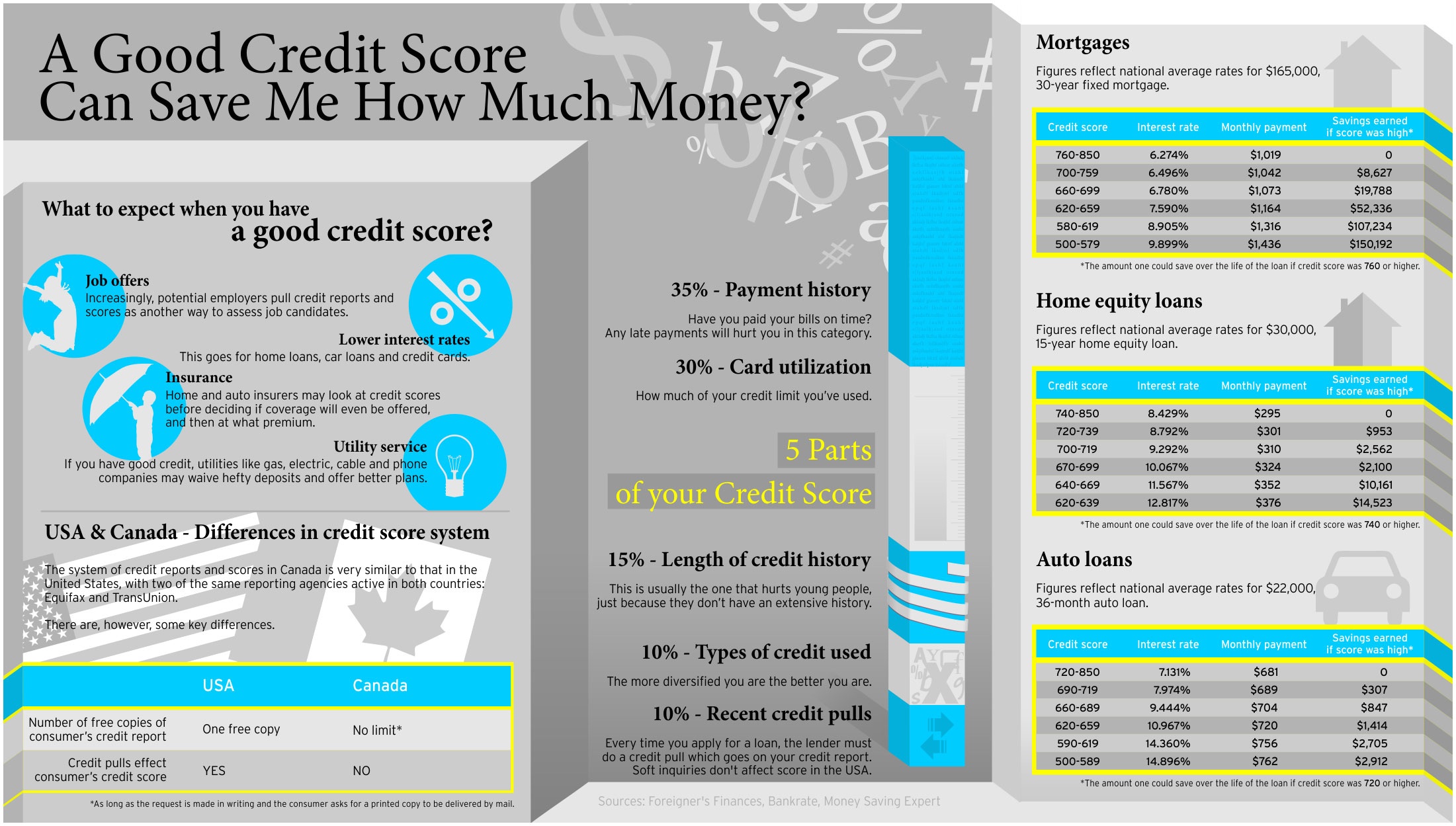

Much has been said about the credit industry and there are endless debates about the merits of the credit score system — especially how you build credit. However, the fact of the matter is that our economy (at least here in the U.S.) is largely based on consumer spending that happens to be based on credit and debt. Indeed, a bad credit score can hurt you in unexpected ways. A good credit, score, though, can open doors and save you money. This infographic from CreditLoan.com, a company offering financial advice on bad credit loans, provides a look at how a good credit score can help your financial life.

The main benefit comes in the interest rate that you receive when you take out loans. While a great deal of debt never desirable, most people have to borrow for things like homes and cars. As you can see from the infographic, if you have a good credit score, of between 750 and 759, you could save as much as $43,709 over having between a 620 and a 659 on a home mortgage loan. There are also savings if you get a better rate on an auto loan, and you can save money on your home equity loan.

One thing that the infographic fails to point out is that you could be denied a loan altogether with poor credit, especially in the current climate. On top of that, the infographic points out, your insurance premiums could be higher, and you may be required to pay higher security deposits. Landlords may also decide not to let you rent if you have a poor credit score. So, even if you aren’t planning on borrowing any money in the near future, your credit score can still impact your financial future.

Building a Good Credit History

Being responsible with your finances, and using some credit in a calculated way, is the way to build a good credit history that can help your finances down the road. While you may not want to borrow for anything, you may have to. It’s about making calculated credit decisions as part of your overall financial plan. The infographic offers a quick overview of what goes into a credit score (the score system in the U.S. and Canada are very similar), and you can see how important your payment history is. If you want to have a payment history, unfortunately, you have to make payments — on time and in full, of course. It might be wrong, but the system actually punishes people who live a cash lifestyle, and then suddenly decide it’s time to get a home mortgage loan, or who find that their insurance premiums are higher because of a lackluster credit score.

Checking Your Credit History

It is a good idea to regularly check your credit history. In the U.S., you are entitled to one free credit report each year from each of the major credit bureaus via www.annualcreditreport.com. In Canada, you can have as many free copies of your report as you want, as long as you request the report in writing and have it mailed to you. When you check your own credit report, it won’t reflect on your credit score. In Canada, your score isn’t affected no matter who checks.

In the U.S., though, a hard credit pull by someone else when you get a loan, will lower your credit score to some degree. You will have to pay for access to your credit score.

Make sure you keep up with your credit history, and check for errors and signs of fraud. And do what you can to keep a good credit score. Your finances will thank you.

Miranda is freelance journalist. She specializes in topics related to money, especially personal finance, small business, and investing. You can read more of my writing at Planting Money Seeds.