- 179shares

- Facebook95

- Twitter8

- Pinterest70

- Google+6

This is the third post on the Financial Planning Basics series, if you have not read the last post click here.

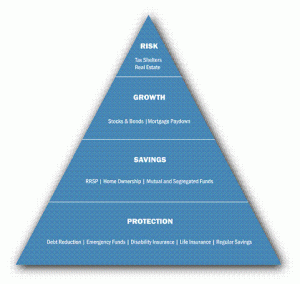

Understanding the Financial Pyramid is an essential part of understanding the financial planning process. I will try to outline the basic concept of the Financial Pyramid as it applies to personal financial planning.

The Financial Pyramid is a visual aid to help understand the necessarily steps to reaching financial freedom, just like a pyramid it has several layers starting from the base to the tip.

The Base-The Financial Plan

The financial pyramid starts with a base foundation, which is a written financial plan. This can be as detailed and complicated or as simple as you want it to be, it generally starts of fairly simple and develops overtime in a more complex plan.

Things that usually belong in your written financial plan are:

- Your short and long term financial goals

- Insurance coverage and

- Your Investment Policy

This is the base of the pyramid and the foundation of your financial plan, this will be your guide throughout the next few decades and will be updated as your situation changes. Think of it as a map for a road trip, it will guide you to your destination.

The Financial Pyramid

- The Financial Plan

- Protection

- Insurance, Will and Power Of Attorney’s

- Debt Reduction

- Emergency Savings

- Savings

- Home and RRSP, TFSA

- Wealth Building

- Non-Registered Investment

- Speculation

- Real Estate, Art, Collectibles

Level 1- Protection

One stage that is way to often forgotten and not seen as important is the protection stage in your financial pyramid. This stage is a very crucial stage in planning and usually includes the following items:

- Insurance (Life, Health, Disability, Critical illness Insurance etc)

- Will and Power Of Attorney’s (health and property)

- Establishing an Emergency Fund (3-6 months of salary)

In many cases when I talk to individuals and families about their financial plan this stage is either missing or incomplete in their financial plan, however without appropriate protection your whole financial plan is at risk. As you can see, from the illustration, it is located at the bottom of the financial pyramid and is a large part of the pyramid, what happens if its too small or too loose? The whole pyramid will be at risk, one small unexpected change can cause the whole pyramid to collapse.

The purpose of the stage is to provide you with a cushion in case of an unexpected event such as job loss or health issues, if you do not have enough in emergency savings or insurance chances are that you will dig into your long-term savings which will undoubtedly jeopardize your long term goals.

Level 2- Savings

This is the stage where most people start their financial plan, it’s the savings stage. Some common items at this stage are:

- Purchasing a home

- Contributing to RRSP and TFSA accounts

- RESP

You should continue to this stage only and if only you have completed the first steps, otherwise your financial plan will be at risk. You should have a valid Will and POA’s as well as enough Emergency fund and Insurance to purchase a home and make comfortable contributions to your RRSP.

The purpose here is to start building your wealth and investments, it’s the first stage at the journey to financial freedom.

Level 3- Wealth Building

It’s an extension to the second level, ones you have become a home owner and have adequately funded your RRSP’s and TFSA accounts you can start building non-registered investment portfolio’s. It does not make a lot of financial sense to have a taxable investment portfolio if your tax deferred (RRSP) and tax free (TFSA) accounts have contribution room.

Level 4- Speculation

Ones you have reached a level where your debt is low or zero, you have enough retirement funds and enough wealth accumulated in your investments you can start speculating. Speculation is very risky and only a very small portion of your assets should be invested in it, generally maximum of 5%. Speculation could range from buying speculative investments, like junior gold companies to investing in private partnerships. Again the important point to remember is that only a 5% of your assets should be in here.

Summary

Understanding the financial pyramid is an important part of financial planning, it is also a good way to visualize the importance of certain stages. If you climb the financial pyramid in the specific order and one level at a time you will have a solid financial plan and be able to weather short periods of financial hardship without jeopardizing long term goals.

Financial Planning Basics- Guide To Financial Planning

- Intro: Pre-Work to step 1

- Step 1: Balance Sheet, Networth and Cashflow Statement

- Step 3: Budgeting