- 14shares

- Facebook13

- Google+1

I have many friends who believe they are too young to invest and think about retirement, many times I have tried to explain to them the benefits of investing early, it was not until I showed them how compounding works till they understood importance of early investing.

In a lot of instances young people are not thinking of investing, they rather buy the newest cars and gadgets, in other cases some believe that small investments is not going to do much for their future. In both situations these people miss the important concept of compounding.

Compounding in simple terms is interest earned on top of interest. Here is a simple example, say you get 10% interest on your investment and you start with $100:

1st payment=$10 ($100X0.1)

2nd payment=$11 ($110X0.1)

3rd payment= $12.1 ($121X0.1)

4th payment= $13.31($133.1X0.1)

And so on, you see the interest payments increase with each payment and it’s added to your account where you earn interest on it.

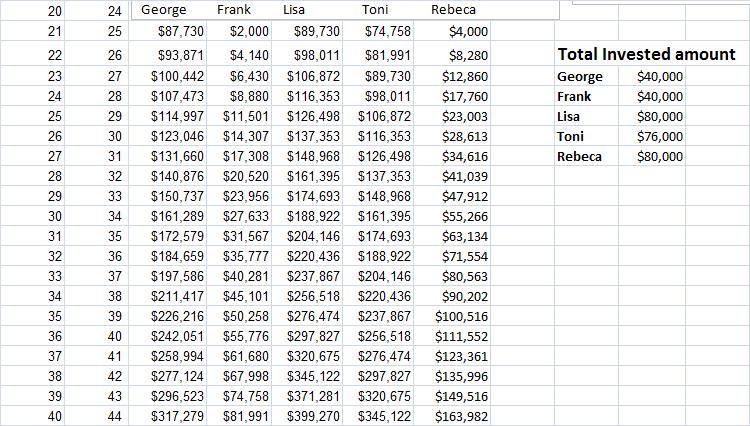

Due to compounding if you miss early years of investing it will be extremely hard to catch up, I have developed a compounding spreadsheet showing the affect of compounding on your investments. You can enter your own values and it will compute the growth over several decades. I have also included 5 case studies of individuals investing at different times to illustrate the importance of early investing.

Let’s take a quick look at an example:

George: Invests $2000/yr consistently for 20 years he stops contributing after 20 years, and let’s compounding do the work.

Frank: Frank is a little slow so he starts investing 20 years After George, he consistently invests $2000/yr for 20 years.

Lisa: Lisa, like George, invests the $2000/year consistently but unlike George she contributes for 40 years.

Toni: He missed the first 2 years, but after that he invests $2000/year for the rest of the time.

Rebeca: Rebeca has a different style, she skips the first 20 years, Like Frank, but unlike him she. contributes Double the amount ($4000/year) Half the time, she figures she’d do much better that way.

Let’s take a look at year 40 and see who came out on top.

After 40 years:

George value: $317K Total invested: $40K

Frank value: $82K Total invested: $40k

Lisa value: $399K Total invested: $80K

Toni value: $345K Total invested: $76K

Rebeca value: $163K Total invested; $80K

It is obvious that Lisa came out on top, because she invested the most for the longest time. Let’s look at 2 specific cases to illustrate power of compounding:

1. Rebeca vs George: Both invested for 20 years and Rebeca invested twice as much as George BUT her value is almost HALF of George’s!

2. Toni vs Lisa: Lisa invested for 20 years while Toni missed 2 years and invested for 18 years. The difference in the amount of investment is only $4000, but the end value difference is $54,000! Two years and $4000 made a $54,000 difference in the end! Even if we were to make things even and let Toni add 2 more years to catch up to 20 years and Lisa does not add anymore just let it grow, the difference would be over $20,000.

This shows the importance of early investing. It’s never too early to start and no amount is too small, a small amount today can go a long way.

The lesson:

Start investing a small amount today and do it consistently, and take advantage of the magic of compounding!