Filing taxes can be a complicated matter, whether it’s trying to understand the terms or figuring out the forms. You may not know what to include in your deductions or how to count a donation. You may be concerned about the changes in the tax laws since last year, and how that will affect you when you file this year.

You will find numerous tax apps for either your iPhone or your Android device that can help make tax time a little less complicated and more convenient for you. Here are some of the most useful apps you can use.

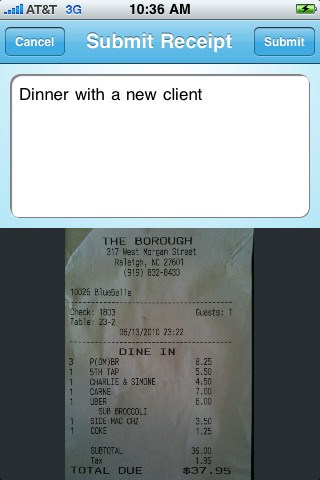

Shoeboxed

It can be difficult to keep track of all your receipts throughout the year for tax time. Shoeboxed makes it easy with their mobile app for iPhone users. All you have to do is take a photo of your receipt and the app enters the date, total, payment type, store, and category. It will send an expense report to your email and upload it into various accounting software such as Quicken or QuickBooks. [See detailed Shoeboxed Review] Cost: Free

SnapTax by Turbo Tax

File your taxes over your phone with SnapTax and it works for either iPhone or Android users and in all 50 states, in Canada it is only available on the iPhone. You take a picture of your T4/W-2 and it enters the information automatically on the correct lines. You just have to answer a few questions and review it for accuracy. All it takes is a click and your taxes are filed with both federal and state. It is designed for simple returns and costs just $14.99 USD and $9.99 CAD when you are ready to e-file. [SnapTax Canada Review]

1040EZ Tax App from H&R Block

For people with an iPhone, they can use the trusted name of H&R Block to file their taxes. The 1040EZ Tax App allows them to file both federal and state taxes with one app. They can take a picture of their W-2 and it will input into the federal form. Once it is reviewed for accuracy, the information rolls over into the state return. You still get represented by an authorized agent should you ever be audited. The cost is free.

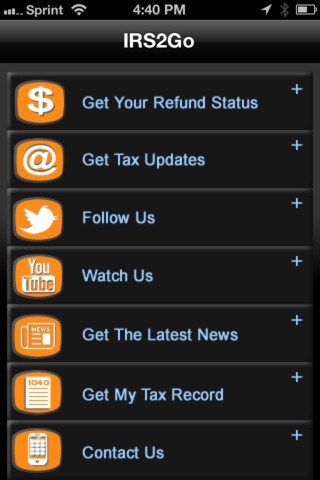

IRS2GO

If you want to know the status of a return you have filed, IRS2GO will give you an update. This app is for both iPhone and Android users and is directly from the IRS. You can sign up for free tax tips or order a copy of your tax record. Cost: Free.

2011 Tax Reference

It can be helpful to have a tax reference guide at your fingertips. With the 2011 Tax Reference app from Palmer Financial, you’ll have access to any information you might need on taxes. It will provide valuable help on business taxes, personal tax rates, itemized deductions, as well as many other topics. You will also get access to regular alerts on filing deadlines. Cost: $2.99

TaxCaster by Turbo Tax

If you want to know what to expect from your refund before you get you W-2s, you can get an estimate from TaxCaster by Turbo Tax. You just have to enter some basic information about your filing status and input your wage information and deductions and the app will give you an approximate total. Based on the information you provide, it will even recommend the best Turbo Tax product for you to file your taxes. It works on both iPhones and Android phones. Cost: Free.

iDonatedIt

If you wonder how much you can claim when you donate old furniture or clothes, you need iDonatedIt app for your iPhone or Android. This app can track the items you donate and which charity received them and estimate fair market value. You can even take a picture of the items you donated and it will attach it to the report and email it to you. This creates a permanent record for the IRS. Cost: $2.99

These apps can help you save time and make tax filing somewhat less complicated. For more resources and discounts visit our Tax Center.